Uber is continuing to expand mobility with the nationwide rollout of its newest ride option. On Tuesday, Uber announced it's giving riders "an upgrade to your everyday ride," with Uber Comfort. The newest product, built for riders who want — as the name suggests — an extra level of comfort as they get to where they need to go, is being rolled out in 43 cities across the country, plus Ottawa, Canada. Here is what you need to know about Uber's upgrade as well as how you can offset the extra cost with the right credit cards.

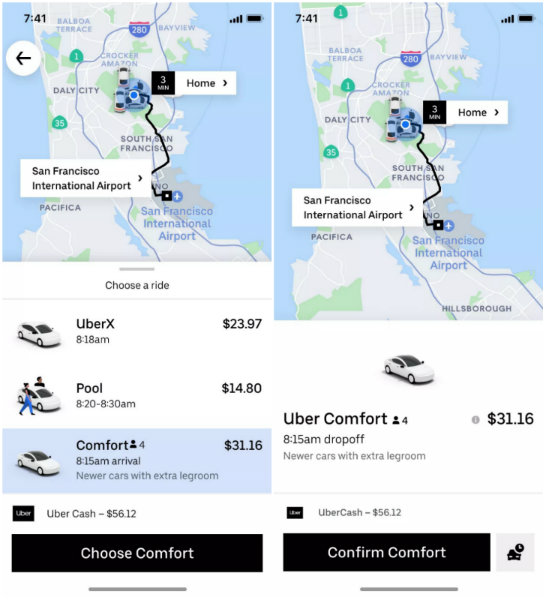

Slotted between the popular UberX option and the top-tier Uber Black service, riders who choose Uber Comfort can expect to pay 20-40% more per ride than an UberX. With the higher price, however, comes a few added features in return:

- Newer, mid-size cars: Travel comfortably in a car that meets "consistent vehicle make and model standards."

- Extra legroom: Minimum legroom requirements so you can stretch out and enjoy some added space beyond what's required for UberX.

- Rider preferences: Request your ideal temperature in advance and let the driver know if you prefer a quiet ride.

While some of these benefits are drawn from Uber Black and Black SUV rides — particularly temperature control and quiet mode — this collection of rider preference features is unique to Uber Comfort, according to Uber's announcement post. What sets Uber Comfort apart from other services is the option for a roomier ride.

It may not be a premium service, but if you're willing to pay for an enhanced experience beyond a regular UberX ride so you can stretch out, blast the A/C, and ride in silence, Uber Comfort may be the way to go. We've all been there: hoping for a little more legroom than what we got, maybe a little quiet time for a nap or to get some work done, and who wouldn't want the perfect climate welcoming us already as we climb inside?

While these upgrades are definitely not free, several of the best travel credit cards can help offset the added cost. The Platinum Card® from American Express, for instance, offers cardmembers up to $200 in annual credits for Uber rides (starting 11/8/2024, you must use an Amex card as the payment method to redeem your Amex Uber Cash benefit), while the Chase Sapphire Reserve® boasts a $300 travel credit that can be used to erase your Uber costs.

To qualify to drive with Uber Comfort, drivers need a car that meets the make, model, year, and legroom requirements, in addition to having a driver rating of 4.85 or higher. This list of vehicles that provide the minimum requirements for Uber Comfort is pretty extensive, but includes the Toyota Camry, Dodge Durango, Audi SQ7, Chevy Tahoe, and more.

Uber Comfort is now available in the following cities:

Atlanta, Austin, Baltimore, Boston, Charleston, Charlotte, Chicago, Connecticut, Dallas, Fresno, Hampton Roads, Houston, Honolulu, Indianapolis, Kansas City, Las Vegas, Los Angeles, Madison, Memphis, Milwaukee, Nashville, New Jersey, New Orleans, Omaha, Orange County, Ottawa, Palm Springs, Phoenix, Pittsburgh, Portland, Raleigh-Durham, Rhode Island, Richmond, Sacramento, Salt Lake City, San Antonio, San Diego, San Francisco, Seattle, St. Louis, Tampa Bay, Tucson, Wichita, and Washington D.C.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2019/07/10/woman-riding-in-uber-comfort-class.jpg)

/authors/matt-miczulski-headshot.jpg)

/authors/becca-borawski-jenkins-fbz.jpg)

/images/2024/12/16/bofa-travel.png)