If you are looking for a way to continue earning Delta SkyMiles but don't have any flights planned, the SkyMiles Dining program could be a great way to keep earning valuable miles. With the average American spending over $3,000 on eating out per year, there are some serious rewards you might currently be missing out on.

Plus, who wouldn't want to fill their stomachs and SkyMiles balance simultaneously? In this article, you'll learn about the SkyMiles Dining program and how it can help you earn more Delta SkyMiles.

What is Delta SkyMiles Dining?

SkyMiles Dining is a dining rewards program offered by Rewards Network that allows members to earn Delta SkyMiles by dining at partner restaurants. With the ability to earn miles at over 10,000 restaurants across the U.S., there are plenty of opportunities to earn airline miles. These 10,000 restaurants range from large chains like Pizza Hut to small, hole-in-the-wall restaurants, so it's likely there are restaurants to fit your tastes.

How does Delta SkyMiles Dining work?

After a quick sign-up, you can be on your way to earning valuable Delta SkyMiles by eating out.

- Start by going to SkyMilesDining.com

- Hit the red "join now" button in the top right corner

- From there, you'll sign up for your SkyMiles account; you'll need your Delta SkyMiles number to complete your registration

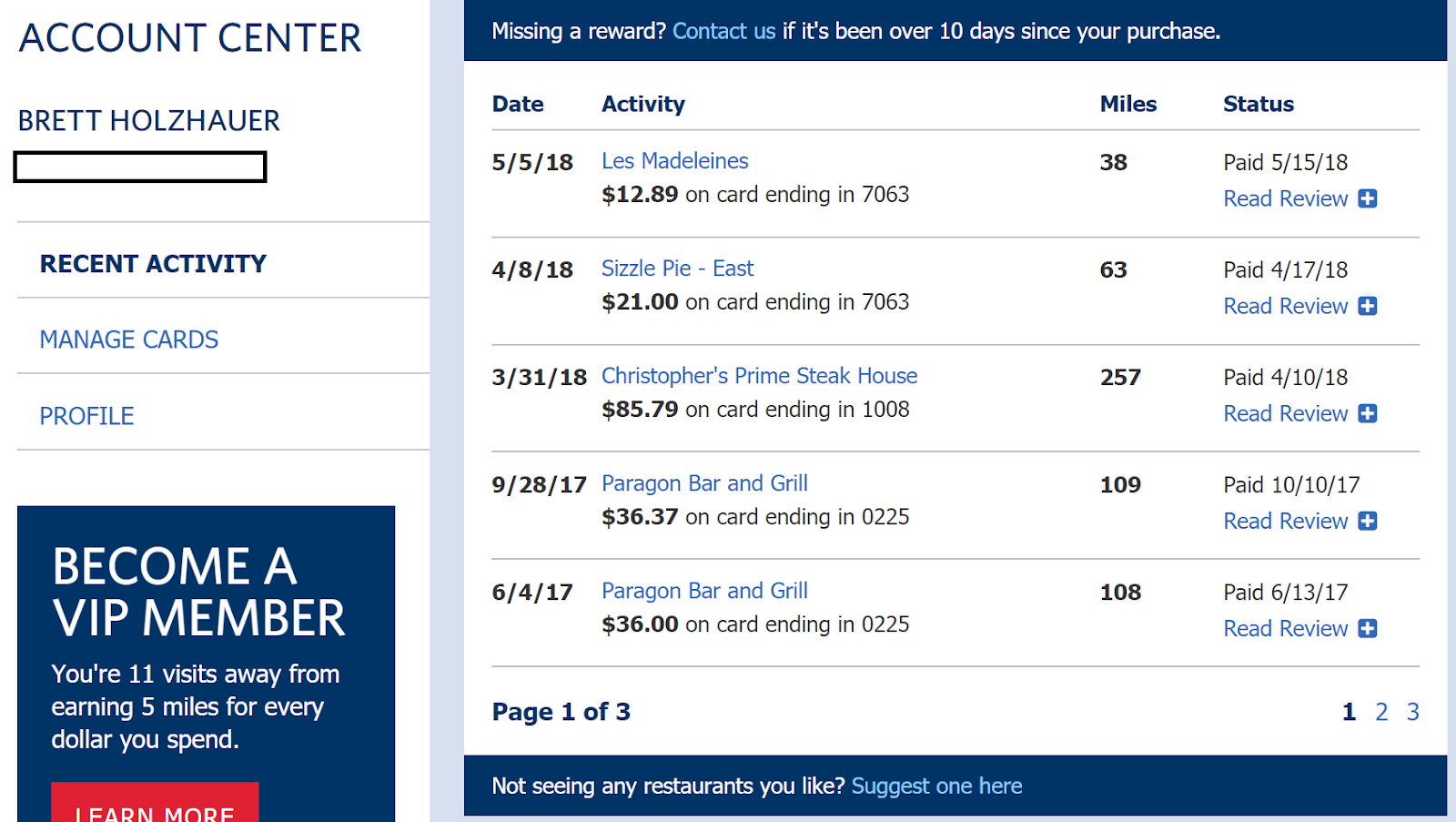

The next step is to register the credit cards you normally pay with when you eat out. Once you charge your meal, you'll receive an alert that the coordinating amount of Delta SkyMiles will be deposited in your account. You'll be awarded your SkyMiles around 10 days after your purchase.

The best parts about this program are that it's 100% free and simple to use — and there are intro bonuses to be earned as well. Right now, you can earn up to 3,000 Delta SkyMiles by registering for an account, completing three restaurant visits while spending at least $30 each time, and completing surveys after each visit. Skymiles Medallion members can earn an additional 500 extra bonus miles from their first restaurant visit.

How many miles can you earn with SkyMiles Dining?

So, how much can you earn with the SkyMiles Dining program? Well, not a ton, unfortunately. Your miles also don't count toward airline status.

While that's not too exciting, belonging to SkyMiles Dining can actually still be a good idea because it's a very passive and easy way to earn Delta miles. If you're consistently eating at the same restaurants and they're in the Delta SkyMiles network, there's no reason not to take advantage of the dining program.

The amount of Delta SkyMiles you can earn with this program depends on two factors: how much you're spending and your membership level. Your membership level is determined by whether you opt into receiving emails and how often you visit restaurants in the program.

| Membership level | SkyMiles rewards rate |

| If you don't opt into emails | One mile per $2 |

| If you do opt into emails | Three miles per $1 |

| If you opt into emails and also complete 11 qualifying visits in one calendar year | Five miles per $1 |

To make this program remotely worth it, you need to at least opt into the emails. If you aren't a fan of receiving marketing emails, I recommend setting your email program to automatically filter any Delta emails into a folder. This simple strategy will keep your inbox uncluttered and earn you six times more miles on every restaurant bill.

How to find Delta SkyMiles Dining restaurants

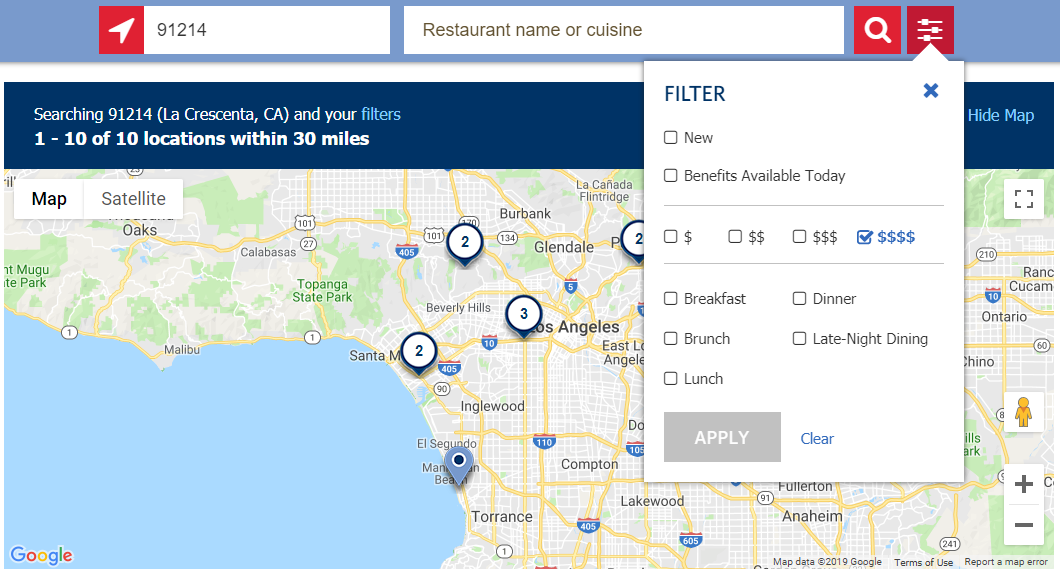

The simplest way to find restaurants participating in the SkyMiles Dining program is to visit SkyMilesDining.com. On the homepage, you'll see a search bar where you can input your city and the restaurant name or cuisine you're looking for.

Once you've done the initial search, you can then also filter by several different categories, like price or type of meal.

When I searched my zip code (a suburb of Los Angeles), I was given nearly 500 options to choose from, ranging from cheap eats to luxury dining. My wife and I typically use this program to search for new local restaurants to further increase our points earnings.

This program won't make you "points rich," but if you spend $3,000 a year on eating out, your earnings in this program could be 15,000 Delta SkyMiles. And that amount of points could make the difference between a paid flight and award flight.

How to use your credit cards to earn more SkyMiles

While the SkyMiles Dining program won't make you "points rich," adding the best travel credit cards to your billfold can. If you do this, you can earn Delta SkyMiles from the SkyMiles Dining program along with the miles or points earned directly on your cards.

Using a Delta credit card could earn you a significant amount of Delta SkyMiles for your next flight. However, Delta's co-branded credit cards don't have the best spending categories. With most of its cards, you earn bonus points when spending with Delta on flights or on inflight purchases. All other purchases only net you one point per dollar. The only exception to the rule is the Delta SkyMiles® Blue American Express Card. You can earn 2X miles on eligible purchases made directly with Delta and at restaurants worldwide, plus takeout and delivery in the U.S., and 1X miles on all other eligible purchases, but that still isn't all that great.

However, if you use a non-Delta rewards credit card that has a bonus category with high earnings for spending at restaurants, you could be bringing in heaps of rewards in no time. If you're a foodie or consistently eating out for business, it's worth considering one of the cards below to boost your points and miles balances.

To start earning with these non-Delta cards, simply visit the SkyMiles Dining website, log into your account, and register any cards you'll be using at the program's partner restaurants. This takes about two minutes — and then you can be eating your way to more Delta SkyMiles every time you used a linked credit card.

| Card | Welcome bonus | Rewards rate | Travel benefits | Annual fee |

|---|---|---|---|---|

| American Express® Gold Card | Earn as high as 100,000 Membership Rewards Points after you spend $6,000 in eligible purchases within the first 6 months of card membership (welcome offers vary and you may not be eligible for an offer; apply and find out your offer) | 4X Membership Rewards points at restaurants worldwide (up to $50,000 per year, after that 1X), 4X at U.S. supermarkets (up to $25,000 per year, after that 1X), 3X on flights booked directly with airlines or on AmexTravel.com, 2X on prepaid hotels and other eligible purchases booked on AmexTravel.com, and 1X on all other eligible purchases | Global assist hotline, baggage insurance plan, car rental loss and damage insurance (secondary coverage), and premium roadside assistance | $325 |

| Chase Sapphire Reserve® | Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening | 8x points on all purchases through Chase Travel℠ (including The Edit℠), 4x points on flights and hotels booked direct, 3x points on dining worldwide & 1x points on all other purchases | Trip cancellation and interruption insurance, auto rental collision damage waiver (primary coverage), lost luggage reimbursement, and trip delay reimbursement | $795 |

| Chase Sapphire Preferred® Card | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening | 5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases | Trip cancellation and interruption insurance, auto rental collision damage waiver (primary coverage), lost luggage reimbursement, baggage delay insurance, and trip delay reimbursement | $95 |

| Capital One Savor Cash Rewards Credit Card | Earn a one-time $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening | 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services; 5% back on hotels, vacation rentals and rental cars booked through Capital One Travel; 8% cash back on Capital One Entertainment purchases; and 1% cash back on all other purchases | Complimentary concierge services, MasterRental® Coverage1 <p class="">For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.<br></p> | $0 |

| Bank of America® Customized Cash Rewards credit card | Earn a $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening | 6% cash back for the first year in the category of your choice, 2% at grocery stores and wholesale clubs, and unlimited 1% on all other purchases. After the first year from account opening, you'll earn 3% cash back on purchases in your choice category. Earn 6% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. After the 3% first-year bonus offer ends, you will earn 3% and 2% cash back on these purchases up to the quarterly maximum | None | $0

|

The cards listed here earn bank-specific points rather than brand-specific points. These points are typically more valuable, as they can be transferred to a number of different airline programs rather than being stuck with one brand. But, if you're loyal to a single airline, there's no harm in finding the best airline credit card to maximize your rewards.

Let's take the American Express® Gold Card, for example. Because of its healthy welcome offer coupled with its ability to earn 4X Membership Rewards points at restaurants worldwide (up to $50,000 per year, after that 1X), 4X at U.S. supermarkets (up to $25,000 per year, after that 1X), 3X on flights booked directly with airlines or on AmexTravel.com, 2X on prepaid hotels and other eligible purchases booked on AmexTravel.com, and 1X on all other eligible purchases, the Amex Gold Card is a must-have for any foodie or restaurant connoisseur. With it, you can quickly earn Membership Rewards points on many of your purchases. You can then transfer these Membership Rewards points directly to Delta SkyMiles at a 1:1 ratio. Earning these kinds of transferable points is a much more effective way to earn large quantities of Delta SkyMiles than the co-branded Delta American Express cards, as the earning categories are very limited with the Delta cards.

I recommend both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® because, while you can't transfer Chase points directly to Delta SkyMiles, you can transfer them to the Virgin Atlantic Flying Club. Given Delta and Virgin Atlantic's working partnership, this transfer will allow you to use points that originated from your Chase cards to book Delta flights. You can transfer your Chase points to Virgin Atlantic Flying Club at a 1:1 ratio.

And if you're a fan of simply saving money on your restaurant purchases, you can't go wrong with the Capital One Savor Cash Rewards Credit Card, as this card offers 3% cash back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services; 5% back on hotels, vacation rentals and rental cars booked through Capital One Travel; 8% cash back on Capital One Entertainment purchases; and 1% cash back on all other purchases.

In summary, if you're someone who spends a significant amount of money on restaurants and wants to earn more Delta SkyMiles, I strongly suggest you apply for a card that earns transferable points. The American Express Gold Card is my all-time favorite card because of the ability to transfer points and the rewards I earn from my wife and I dining out.

FAQs about Delta's dining program

What is SkyMiles Dining?

SkyMiles Dining is the rewards program that's offered by Delta. You can earn Delta SkyMiles when you dine at a partnered restaurant.

Depending on your SkyMiles Dining membership status, you can earn up to five miles for every dollar you spend at participating restaurants using a linked credit card.

What credit cards earn Delta SkyMiles?

There are no specific credit card needed to earn miles through Delta's SkyMiles Dining program. You can link any credit or debit card to your SkyMiles Dining account to start earning miles.

To avoid missing an opportunity to earn miles through the SkyMiles Dining program, you can link multiple cards to your dining rewards account.

You can also use a Delta credit card to earn SkyMiles on almost all your spending, even if you're not dining at a partner restaurant.

How do I use Delta SkyMiles?

When you're ready to redeem your earned Delta SkyMiles, log in to your Delta account online or use the Delta app. You can redeem miles for travel, Delta gift cards, VIP experiences, through the SkyMiles Marketplace, or donate them to a charity of your choice.

What purchases earn SkyMiles?

Eating at participating restaurants, bars, and clubs, and using a card that you registered through SkyMiles Dining, earns you SkyMiles through this dining program.

How do I earn SkyMiles fast?

There are a few ways to earn SkyMiles quickly through Delta's dining program:

- New member bonus. New SkyMiles Dining members can earn up to 3,000 bonus miles. Within the first 30 days of opening an account, make three visits to a participating restaurant and spend at least $30 (including tax and tip). Complete the post-dine survey and you'll earn tiered bonus miles.

- Opt-in to email newsletters. Choosing to receive SkyMiles Dining newsletters earns you three miles per dollar, compared to a half mile per dollar when you opt-out of emails.

- Earn VIP status. Reach 12 qualified dining visits and earn VIP status. VIP members then earn five miles per dollar spent through SkyMiles Dining.

- Link multiple cards. Don't miss out on miles because you left your linked card at home. Link multiple cards to ensure you're earning miles at participating restaurants, no matter which you use to pay.

How many SkyMiles are needed for a free flight?

Unfortunately, Delta Air Lines does not publish an award chart for free flights. That means the exact number of miles you need depends on the route you choose and when you fly, among other factors.

The Delta SkyMiles® Gold American Express Card, Delta SkyMiles® Platinum American Express Card, Delta SkyMiles® Blue American Express Card, or Delta SkyMiles® Reserve American Express Card cardmembers use "Pay with Miles" in 5,000-mile increments when booking travel.

Learn more about redeeming airline rewards for a free flight.

The bottom line on Delta's SkyMiles Dining program

The Delta SkyMiles Dining program is perfect for someone who either enjoys eating out or is consistently traveling for work. While I wouldn't go too far out of my way to earn a few extra Delta SkyMiles, the restaurant search tool can be a great place to start in finding the perfect place for your next date night or client dinner. That new restaurant down the street may just be participating in SkyMiles Dining, and you could earn a few extra miles for your next Delta flight, which can come in handy if you're a frequent flyer on Delta.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2019/09/03/what_you_need_to_know_about_the_delta_skymiles_dining_program.jpg)

/authors/brett-holzhauer_MFcfJxO.png)

/authors/becca-borawski-jenkins-fbz.jpg)

/images/2024/12/16/bofa-travel.png)