Although you may not have heard of it, CheapAir has been helping people find affordable flights since 1989. Headquartered in Calabasas, California, its team of 125 people has analyzed airfare data from over 1.3 billion trips to deliver information on the best time to book flights all over the world.

Unlike other discount airfare sites, CheapAir has pioneered several aspects of the industry, namely by becoming the first travel agency to accept Bitcoin (in 2018) and offering an exclusive Price Drop Payback program that pays you back if flight prices drop after booking.

While you can book flights directly through its online platform, the company also offers a number of free tools to help you know the best time to book your flight — meaning you can take that info and book through your preferred travel rewards account. We'll cover all that and more in this article.

How can CheapAir save you money?

CheapAir claims to show you cheap flight information that other sites can't. But whether or not that's true, it certainly does seem to have a set of helpful (and free) tools for travelers in need of a cheap flight.

Flight search platform

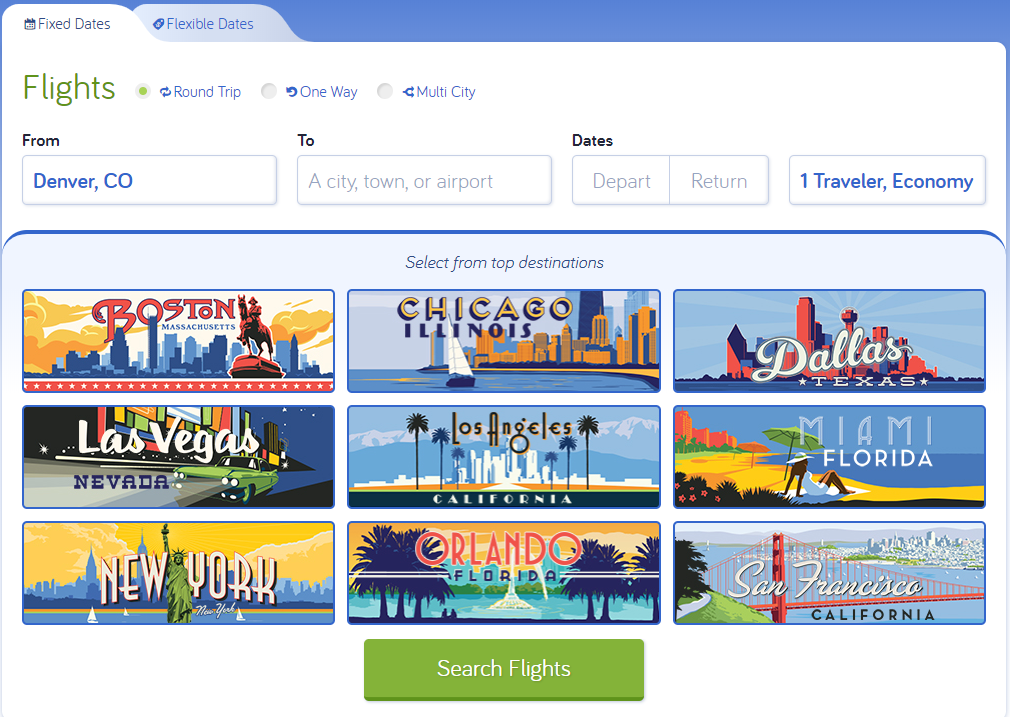

The first of these tools is CheapAir's flight search. Its search, like many airline trackers, allows you to enter dates of travel, number of travelers, and departure and arrival locations to find the best deals across several airlines.

The CheapAir search tool is intuitive and easy to use, even allowing you to filter results by seating preferences and showing what inflight amenities you can expect to have. Some flights won't have any amenities listed, while others note when a flight offers things like Wi-Fi, inflight entertainment, and even if your seat will have charging ports. All of this makes it easier to see what you're buying and make a decision based on your travel preferences.

When to Buy Flights tool

For frequent flyers looking to understand just when they should book an upcoming trip, CheapAir's When to Buy Flights tool is a convenient option.

Although this tool doesn't appear to have data on every flight route (e.g., a search from Bermuda to Boston was redirected to their home page), it does offer a ton of information on more typical flight routes — for example, from Boston to Chicago. Using this tool, travelers can gain insight into the lowest and highest price people paid for these flights in the past year, as well as info on the ideal time to book (for the Boston-to-Chicago flight, this was between 65 and 88 days in advance).

The results also show you the average price for a round-trip flight between these cities ($284) and a list of airlines offering those flights. Even if you aren't looking to book a flight immediately, this kind of insight can be helpful for when you finally do — if only to understand the variety of airlines available and how much you should plan to spend on your flight.

FareTracker tool

Another tool CheapAir offers is the FareTracker, which emails you price notifications based on your selected departure and arrival cities. This is a helpful resource for people who have more flexibility in their travel dates, since it may save you money to book when flight prices suddenly drop.

Price Drop Payback

A final great means of saving with CheapAir is its Price Drop Payback. This policy only applies if you purchase tickets through the company platform but essentially guarantees the lowest airfare travel by reimbursing you (in travel credit) for the difference in airfare if prices drop after you book.

It should be noted that this will only apply for amounts up to $100 per ticket and that you'll need to manually check if your fare has been lowered by visiting the "My Trips" section of CheapAir's site.

How to book a flight on CheapAir

To book a flight on CheapAir, start by visiting its search platform and entering your travel dates as well as departure and arrival destinations. If you have flexible travel dates, there's a tab you can select to see more airfare generic options. The platform also allows you to search for and book hotels and rental cars.

Flights can also be booked by calling 1-800-CheapAir.

How you can pay for your CheapAir flight

Besides normal debit and credit card payments, CheapAir also accepts cryptocurrency and wire transfers, and it offers several financing packages. The first of these financing packages allows travelers to select "monthly payments" at checkout and instantly find out what rates and loan packages they qualify for. Loans are given in three-, six-, or 12-month terms, and interest rates vary between 10% to 30%, based on your creditworthiness.

A second version of this is CheapAir's "prequalifying" package, known as "Travel Now, Pay Later." This prequalification essentially works in the same way as the financing described above — with the key difference being that travelers are awarded a "travel budget" and given 21 days to book flights and hotels with the awarded amount. Interest rates and terms for these packages are the same as those mentioned above.

Although prequalifying for a travel budget or paying for your upcoming trip in installments might sound like a nifty plan, these interest rates are relatively high — possibly even higher than what you pay on your current credit card. Because of this, we don't recommend using CheapAir's financing package to pay for your flight. Instead, to save on interest and maximize rewards, consider using your own travel rewards card to book flights found on CheapAir.

How to get the most out of using CheapAir

Ultimately, the best way to use CheapAir doesn't necessarily involve booking flights. You can (and should) use the CheapAir platform and its various tools to find cheap flights. But booking that flight through something like the Chase travel portal or erasing your flight expense with a travel rewards card — like the Capital One Venture Rewards Credit Card — will get you the best deal in the end.

If you're new to travel rewards, the Chase Sapphire Reserve® or Chase Sapphire Preferred® Card might be good travel rewards cards to start with, since both offer a straightforward rewards program with good redemption rates and generous bonuses.

CheapAir is a great resource for finding affordable flights and understanding price patterns. But when it comes time to book? Get one of the best travel credit cards with more reasonable rates and better incentives.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2019/08/12/couple_combined_cheapair_and_travel_rewards_to_save_big.jpg)

/authors/larissa_runkle_updated.png)

/authors/becca-borawski-jenkins-fbz.jpg)

/images/2024/12/16/bofa-travel.png)