Who wouldn't want more ways to earn miles that can be redeemed for free airline tickets or upgrades, especially when you can rack them up simply by dining out? If you're an American Airlines customer (or think you may fly with the airline in the future), you can do just that with the AAdvantage Dining program.

This program allows you to use your own existing debit or credit cards to earn American Airlines AAdvantage miles for purchases made at your favorite restaurants, bars, and clubs. With three different tiers of membership available, you can end up getting as much as five miles for every dollar you spend.

If you're a fan of American Airlines or simply like banking miles for purchases you'd normally make anyway, AAdvantage Dining may be worth checking out. Here's a look at how this program works and how you can earn some serious miles.

What is AAdvantage Dining?

Let's start first by explaining what AAdvantage is. AAdvantage is American Airlines' customer loyalty program, and the AAdvantage miles you earn can be redeemed for fares, upgrades, car and hotel rentals, vacation packages, entry into the Admirals Club, gift cards, and more.

The AAdvantage Dining program allows you to earn even more American Airlines AAdvantage miles when you make purchases at participating restaurants, bars, and clubs. It lets you register one or more credit or debit cards, which it tracks for eligible purchases within the rewards network. You can earn more if you sign up for email communications, complete at least 11 qualified transactions, or use a co-branded American Airlines credit card.

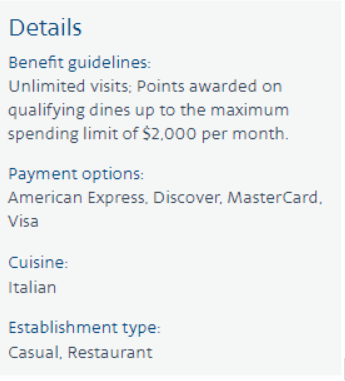

Eligibility of transactions varies from restaurant to restaurant, and the guidelines for which purchases qualify for American AAdvantage Dining points can be found on the participating restaurant's page at AAdvantageDining.com. For example, some limit the amount you can spend to receive points, while others offer points only during certain times of day. It's best to look up a restaurant to see what the terms are beforehand.

AAdvantage Dining is best for those who frequently fly with American Airlines or who plan to fly with the airline in the future and want to start earning miles. The dining program is only available to U.S. residents, not including Puerto Rico or the U.S. Virgin Islands.

How to get started with AAdvantage Dining

Registering for AAdvantage Dining is easy and free. Go to AAdvantageDining.com and complete the form. You'll need to provide the following:

- Name

- ZIP code

- AAdvantage number (if you aren't an AAdvantage member, you can register here)

- Password

You can elect to receive email communications when you register, which will set you up to earn extra miles for every dollar spent (more on that next). If there's a new member bonus at the time you sign up, you can also take advantage of that option.

You can elect to receive email communications when you register, which will set you up to earn extra miles for every dollar spent (more on that next). If there's a new member bonus at the time you sign up, you can also take advantage of that option.

Once your registration is completed, you'll be asked to link a card to your account. This is so your purchases at participating businesses will count toward earning miles. You can also add more than one card so you won't have to remember which one to use when you're out.

How many miles can you earn with AAdvantage Dining?

AAdvantage Dining has three levels of membership: Basic, Select, and VIP status. Each enables you to earn a different number of miles per dollar. The difference between the levels is minimal, simply requiring you to opt into emails and make purchases at participating businesses.

| Membership level | Requirement | Rewards rate |

| Basic | Basic registration | One AAdvantage mile per dollar spent |

| Select | Opt into emails | Three AAdvantage miles per dollar spent |

| VIP | Opt into emails and complete 11 eligible transactions in a calendar year | Five AAdvantage miles per dollar spent |

If you aren't a fan of receiving marketing emails, just set your email program to automatically filter any American Airlines emails into their own folder. This simple strategy will keep your inbox uncluttered and earn you more miles on every restaurant bill.

AAdvantage Dining sometimes has welcome offers for new members. At the time this article was written (Aug. 20, 2019), the program was offering 1,000 miles for spending $25 in the first 30 days of signing up. Since several local restaurants that I often dine at participate in AAdvantage Dining, I'll be able to earn those miles with one dinner if I join now.

The miles you earn should show up in your AAdvantage Dining account within five days, but it will take six to eight weeks before you'll see them in your AAdvantage frequent-flyer account.

How to find participating restaurants

The AAdvantage Dining website has a search tool for finding participating restaurants. For the most part, you'll find local eateries, pubs, diners, and clubs. You can search by city, ZIP code, or the name of the restaurant.

The number of places where you'll earn miles varies from region to region. For example, Paterson, NJ has about 820 participating restaurants within 30 miles, while Myrtle Beach, SC has around 66. In my search of the Myrtle Beach area, I found mostly locally owned restaurants, like Duffy Street Seafood Shack and Bully's Pub. There were also regional chains on the list, such as Eggs Up Grill, Sticky Fingers Ribhouse, and Dickey's Barbecue Pit. Most searches came back with a wide variety of types of cuisine and dining experiences. So you'll have lots of options to suit your tastes.

How to use your credit cards to earn more miles

One really great thing about the AAdvantage Dining program is that you're earning miles in addition to any you get through other programs or cards. There's a lot of potential for stacking rewards for maximum benefits if you're using the best credit cards.

For example, if you have a co-branded American Airlines credit card connected to your AAdvantage Dining account, you can earn up to five miles per dollar spent in the dining program and two points directly to your AAdvantage frequent-flyer account. Having one of these cards can also help you avoid American Airlines baggage fees. This is one of the best airline credit card options if you are a heavy American Airlines flyer.

You can also use a credit card where the credit card issuer allows you to transfer points or miles to American Airlines AAdvantage. If you enroll a co-branded Marriott Bonvoy cards from Chase or American Express in the dining program, you can earn up to five miles in the AAdvantage Dining program and up to two Bonvoy points per dollar. You can then transfer your Marriott Bonvoy points to your AAdvantage account at a 3:1 ratio (i.e., three Marriott points equal one AAdvantage mile).

Another idea is to connect a rewards card to your AAdvantage Dining account that gives you extra points for using it at restaurants. The American Express® Gold Card offers 4X Membership Rewards points at restaurants worldwide (up to $50,000 per year, after that 1X), 4X at U.S. supermarkets (up to $25,000 per year, after that 1X), 3X on flights booked directly with airlines or on AmexTravel.com, 2X on prepaid hotels and other eligible purchases booked on AmexTravel.com, and 1X on all other eligible purchases.

Add to that up-to-five miles per dollar with the AAdvantage Dining program and you could be earning some serious rewards. Keep an eye out for opportunities to earn bonus points by eating at featured restaurants that also participate in AAdvantage Dining.

Here are some of the credit card offers we recommend for you to make the most of the AAdvantage Dining program:

| Card | Welcome bonus | Rewards rate | Travel perks | Annual fee |

|---|---|---|---|---|

| Citi® / AAdvantage® Platinum Select® World Elite Mastercard® | For a limited time, earn 80,000 American Airlines AAdvantage® bonus miles after $3,500 in purchases within the first 4 months of account opening | 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases; and 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases | First checked bag free on domestic American Airlines flights for you and up to four travel companions

Preferred boarding on American Airlines flights 25% savings on eligible inflight food and beverage purchases on American Airlines flights Earn a $125 American Airlines Flight Discount certificate after spending $20,000 in the first year and then renewing your card |

$99 (waived first year) |

| Marriott Bonvoy Brilliant® American Express® Card | Earn 100,000 Marriott Bonvoy® bonus points after spending $6,000 in purchases in the first 6 months | 6X points on eligible purchases at hotels participating in the Marriott Bonvoy® program, 3X points at worldwide restaurants and on flights booked directly with airlines, and 2X points on all other eligible purchases | One annual Free Night Award worth up to 85,000 points Complimentary Marriott Bonvoy® Platinum Elite Status Up to $300 in statement credits annually ($25 per month) for eligible purchases at worldwide restaurants Up to a $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis when you meet specific criteria Statement credit for TSA PreCheck (up to $85 every 4.5 years) or Global Entry (up to $120 every 4 years) Complimentary Priority Pass™ Select membership Annual 25-night credit toward the next level of Marriott Bonvoy Elite status Select benefits require enrollment |

$650 |

| American Express® Gold Card | Earn as high as 100,000 Membership Rewards Points after you spend $6,000 in eligible purchases within the first 6 months of card membership (welcome offers vary and you may not be eligible for an offer; apply and find out your offer) | 4X Membership Rewards points at restaurants worldwide (up to $50,000 per year, after that 1X), 4X at U.S. supermarkets (up to $25,000 per year, after that 1X), 3X on flights booked directly with airlines or on AmexTravel.com, 2X on prepaid hotels and other eligible purchases booked on AmexTravel.com, and 1X on all other eligible purchases | The Hotel Collection upgrades and credits Personalized travel service for planning trips Access to exclusive travel discounts and global assistance Baggage, car rental (secondary coverage), and damage insurance Roadside assistance |

$325 |

| Chase Sapphire Preferred® Card | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening | 5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases | Up to $50 in statement credits each account anniversary year for hotel stays booked through Chase Travel℠ 1:1 point transfer to popular airline and hotel loyalty programs Trip cancellation and interruption insurance, plus baggage delay insurance Auto rental collision damage waiver (primary coverage) Trip delay reimbursement Travel and emergency assistance |

$95 |

| Capital One Venture Rewards Credit Card | Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening (limited-time offer) | 2 miles per dollar on every purchase, every day, 5 miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel and 5 miles per dollar on Capital One Entertainment purchases | Up to $120 credit for Global Entry or TSA PreCheck fee Transfer miles to over 15 travel partners MasterRental insurance Travel accident insurance 24-hour travel assistance1 <p class="">For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.<br></p> |

$95 |

FAQs

How can I earn AA miles fast?

One of the best ways to rack up AAdvantage miles quickly is to apply for an American Airlines credit card. You could earn tens of thousands of miles after meeting the minimum spending requirements — for example, with the AAdvantage® Aviator® Red World Elite Mastercard®, the requirement is both lucrative and simple: Earn 50,000 bonus miles after you make your first purchase and pay the annual fee in the first 90 days.

How much are AA miles worth?

The value of American Airlines miles can vary based on a number of factors, including the itinerary, ticket class, travel dates, cash price of the fare, and more. By comparing multiple flight options, you can determine which one will give you the most bang for your buck. On average, AA miles are worth 1.4 cents apiece, which is better than the standard 1 cent per point or mile you'll get with a lot of general travel rewards programs.

How long does it take for AAdvantage dining miles to post?

It can take up to six to eight weeks for your miles to post to your AAdvantage account, which is when you can use them. However, you'll typically see them post to your AAdvantage Dining Program account within five days.

What other airlines have dining programs?

American Airlines is far from the only airline that offers a dining program. Other options include the following:

- Alaska Airlines — Alaska Mileage Plan

- Delta Air Lines — Delta SkyMiles Dining

- JetBlue Airways — TrueBlue Dining

- Southwest Airlines — Rapid Rewards Dining

- Spirit Airlines — Free Spirit Dining

- United Airlines — United MileagePlus Dining

Depending on your preferences, there are plenty of airlines from which you can choose to focus your efforts.

Bottom line

Though the American AAdvantage Dining program is best for those who are fans of the American Airlines brand or who regularly fly with the airline, it does have the potential to benefit even the casual traveler. Remember, you can also sign up for the American AAdvantage Dining program while using one of the best travel credit cards that isn't co-branded for this airline.

You never know when an American Airlines fare will be your best option. By signing up for AAdvantage Dining, you could earn points while dining out and enjoying life the way you normally would. You'd then end up with a nice bank of points to spend when you're ready to book a flight. Overall, it's not a bad deal. And the rewards don't have to stop there. If you're getting the hang of earning dining rewards, then you might want to check into shopping portals next.

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

/images/2019/09/06/get_the_most_out_of_the_aadvantage_dining_program.jpg)

/authors/robin_kavanagh_updated.png)

/authors/becca-borawski-jenkins-fbz.jpg)

/images/2024/12/16/bofa-travel.png)